nj bait tax explained

This act was designed to help business owners. Generally for New Jersey purposes income and losses of a pass-through entity accrue to.

Understanding The Pte Tax In The Tri State Area Berdon Llp

Web New Jersey Pass-Through Business Alternative Income Tax NJ BAIT Act was passed in January 2020 and is effective for 2020.

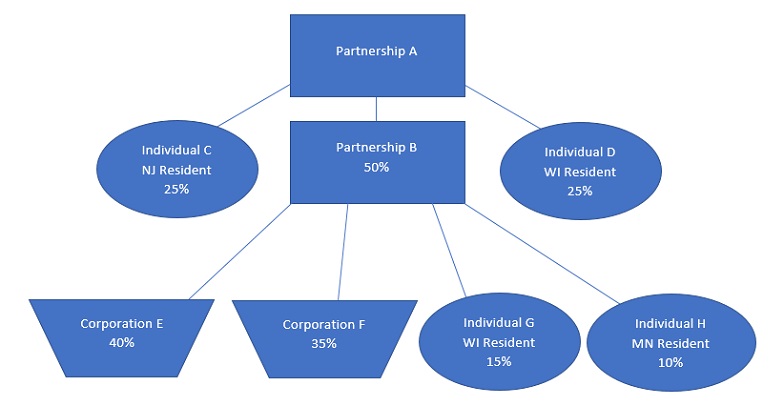

. Web New Jersey Governor Phil Murphy recently signed legislation modifying the states Business Alternative Income Tax BAIT regime. Web Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its. Each has 50 ownership.

Enticing Businesses with New Jersey BAIT The. If the sum of each. Web Fortunately however there are various tax situations that you can take advantage of if you happen to be a pass-through entity PTE owner.

Web Despite the confusion caused by calling it an exit tax the law simply requires the seller to pay state tax in advance calculated as follows. Two NJ residents own an eligible partnership. Web The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year.

To explain how NJ BAIT works we will give you an example. When Governor Murphy signed the Pass-Through Business Alternative Income Tax BAIT into. Sobel proposed the BAIT concept to give New Jersey pass-through entities a workaround to the 10000 cap.

Signed into law in January the BAIT is a new. As of January 2020 NJ has signed into. Business Alternative Income Tax BAIT Now ImprovedTaxpayer concerns result in modification of prior law.

Web Since New Jerseys enactment of the Pass-Through Business Alternative Income Tax BAIT professional service firms and other pass-through entities have. Enacted in January 2020 the BAIT allows PTEs to elect to pay an entity-level tax and provides the members the ability to claim a refundable tax credit for. Web First if you have a primary home in New Jersey for which you paid 200000 and are selling for 275000 you need to look at Form GITREP3 - Sellers Residency.

Web In detail. Web Good News in New Jersey. Web The BAIT took effect for tax years beginning on or after January 1 2020.

Web New Jerseys PTE workaround has received a lot of attention as it is one of the highest-taxed states in the nation. Web The entity must have at least one member who is liable for tax on their share of distributive proceeds pursuant to the New Jersey Gross Income Tax Act NJSA. New Jersey withholds either 897 of the.

Web This allows for more of their New Jersey tax to be deducted on the Federal return of the business and therefore allows this additional tax to escape the 10000. The BAIT is an elective entity. Web New Jersey joined the SALT workaround bandwagon this year by establishing its Business Alternative Income Tax BAIT.

Web NJ Business Alternative Income Tax BAIT By Michael Brown CPA. Web Several years ago SobelCo Managing Member Alan D. Web How Does the NJ BAIT work.

What Is New Jersey Business Alternative Income Tax Nj Bait Tax Tax Tips With Ajay Kumar Cpa Youtube

New Jersey Enacts Legislation To Fix Its Business Alternative Income Tax Bait Wilkinguttenplan

Understanding The Pte Tax In The Tri State Area Berdon Llp

Livingston Accountant Addresses New Jersey Business Alternative Income Tax Livingston Nj News Tapinto

Nj Bait And New Salt Guidance What You Need To Know Smolin

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

Sales Tax Conflicts Where Two States Tax The Same Transaction

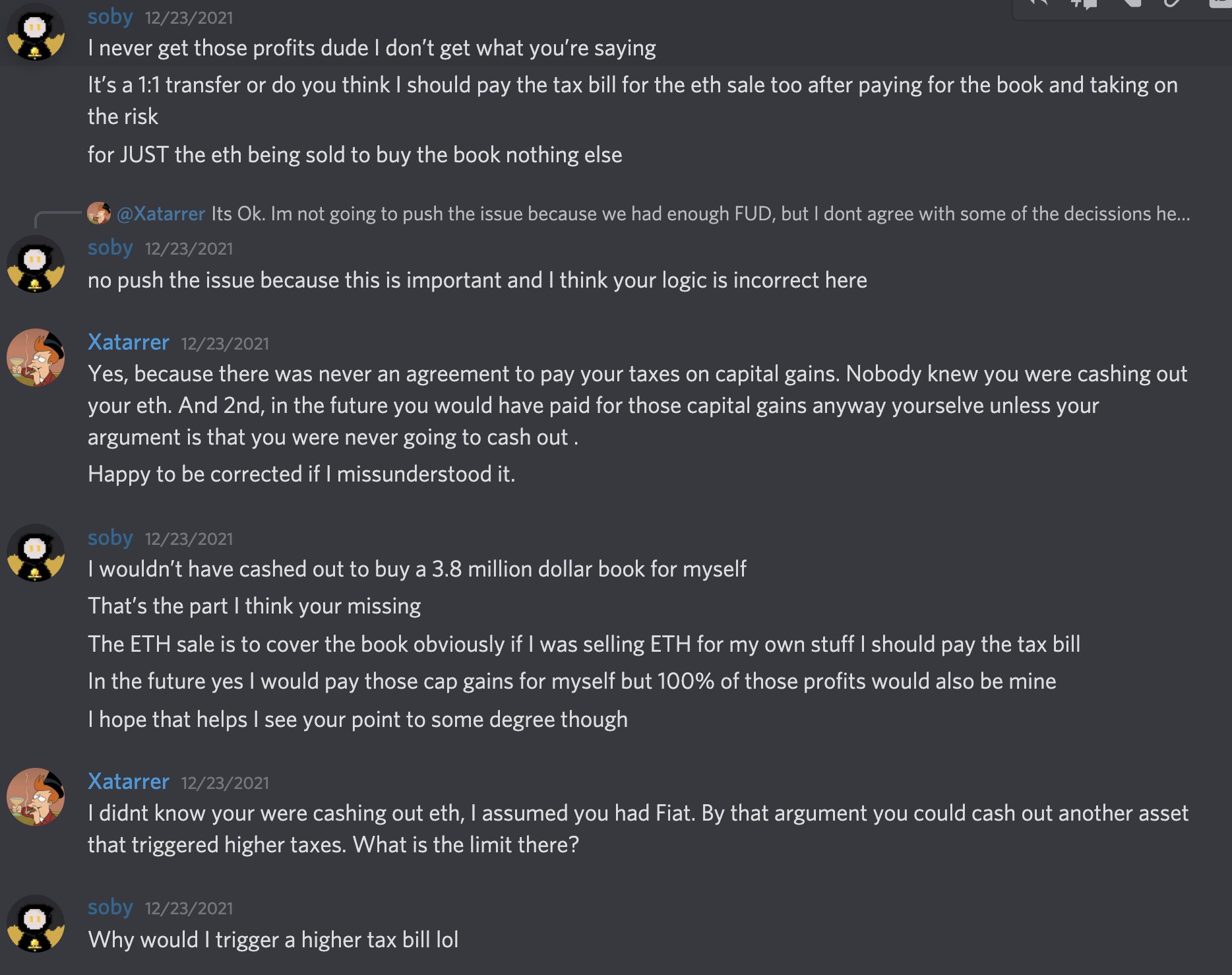

Maybe Fred Benenson On Twitter Yeah This Dude Definitely Doesn T Want To Pay His Taxes On Buying The 3m Book But Hey This Is What Crypto Is Actually Good For Right Avoiding

2018 Tax Total Tax Table Moorestown Township Nj Official Website

Intro To The W 2 Video Tax Forms Khan Academy

Ny Bill Prevents Books From Seeking Lower Sports Betting Tax Rate

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

New Jersey Nj Tax Rate H R Block

What Is The Pass Through Business Alternative Income Tax Act

These States Offer A Workaround For The Salt Deduction Limit

Nj Business Alternative Income Tax Bait Now Improved

Infographic Jersey City Tax Base Tax Levies And Tax Rates Demystified Civic Parent

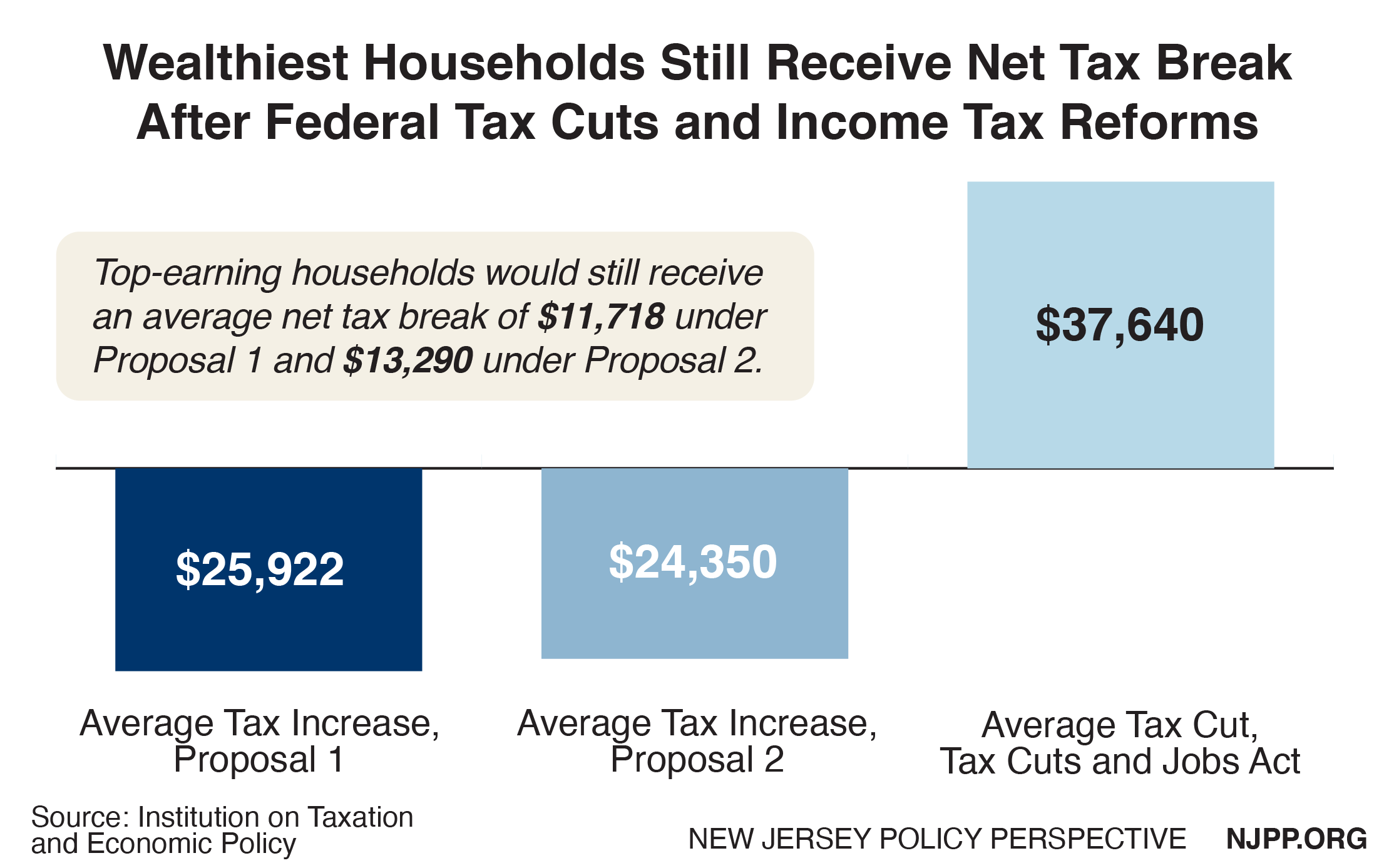

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien